Constancy has minimize the worth of its holding in Meesho by 33.6% because the authentic funding, giving the Indian social commerce startup a valuation of $3.5 billion, adjusted for excellent shares.

The U.S. asset supervisor valued its holding in Meesho at $27.8 million at December’s finish, down from the $41.9 million that it invested within the second half of 2022 by way of a particular mutual fund unit. Constancy made the disclosure concerning the markdown in its month-to-month disclosure on Monday afternoon.

Constancy had marked down the valuation of Meesho to $4.1 billion on the finish of October. The startup was valued at $4.9 billion in its previous funding. The valuation adjustment follows a secondary sale transaction late final 12 months when early backer Enterprise Freeway sold some of its equity in Meesho to WestBridge Capital, TechCrunch first reported. That sale valued Meesho at $3.5 billion, an element which will have contributed to Constancy’s evaluation.

In a press release to TechCrunch, a Meesho spokesperson mentioned: “Funds attribute worth to their portfolio investments, contemplating varied components such because the valuation of comparable firms. Based mostly on Constancy filings, the variety of shares held and the present variety of complete excellent totally diluted shares, the valuation is assessed at $3.5 billion. The rise within the variety of excellent shares, notably because of the ESOP pool enlargement, may have contributed to this valuation shift.”

On the similar time, Constancy has barely marked up the worth of its holding in Reddit, Gupshup and X, in line with the month-to-month disclosure. All of those startups stay far under their authentic funding {dollars}.

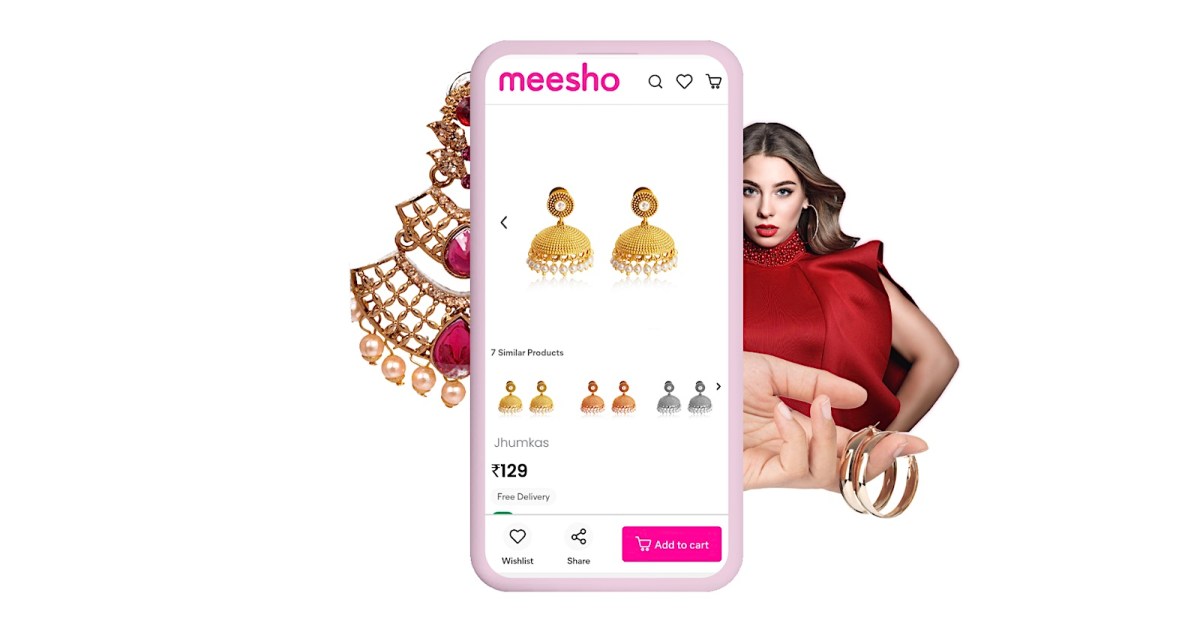

Meesho — which counts Meta, Peak XV, Prosus Ventures, B Capital, and SoftBank amongst its backers — operates a social commerce startup and is among the many quickest rising e-commerce startups within the nation. Its current GMV run rate is over $5 billion, AllianceBernstein reported earlier this month. It’s additionally seeking to increase into new areas — planning to construct a monetary providers platform and scale its grocery supply enterprise, Indian each day Financial Occasions reported Tuesday.

Over 50% of Meesho’s gross sales come from Tier 2 and under cities, permitting it to successfully goal a demographic largely missed by Flipkart and Amazon thus far. Meesho’s strategic prioritization of small cities and deal with mass-market, value-conscious buyer base is paying dividends, in line with AllianceBernstein.

Trending Merchandise