Commingling funds is usually a scary endeavor for individuals who have determined to share their lives with one another. With folks marrying later in life, this typically means shifting in with somebody earlier than any nuptials happen — in the event that they ever do.

This was the dilemma Michelle Winterfield skilled when she moved in along with her associate just a few years previous to getting married. That they had all the standard conversations: opening a joint account and having joint bank cards.

“It’s laborious to construct a life as an single couple,” Winterfield advised TechCrunch. “And with {couples} getting married in a while in life, there may be an unwillingness to mix funds, however they nonetheless need to get the advantages of doing so.”

When Winterfield, who was a personal fairness investor on Wall Avenue, couldn’t discover an app that centered on what she referred to as “the fashionable couple,” she and co-founder Daniel Couvreur, a former funding banker, got down to construct one two years in the past.

Their result’s Tandem, a fintech app that addresses the primary monetary milestones for {couples} and grows with the connection by way of planning, saving and spending options. The subscription-based app launched in August 2023.

“We had been each bored with utilizing Venmo to share hire, groceries, and loads of different bills with our vital others, and we noticed no attraction in a joint debit card/account – who needs to surrender bank card factors/money again and take care of the ache of opening a joint account + combining funds?” Couvreur wrote in a LinkedIn post two years in the past.

Tandem group, from left, Michelle Winterfield, Matthew Dennis, Daniel Couvreur and Emily Brent. Picture Credit: Tandem

The way it works

Customers get arrange on Tandem in minutes. One individual logs in and invitations their associate. Each join their bank card and/or debit card. Tandem pulls in transactions, nonetheless, every associate solely sees what the opposite needs them to see, Winterfield stated.

{Couples} can arrange automated cash transfers right into a shared expense pot and designate it to sure bills, for instance, hire or Netflix. Greater than 25,000 {couples} presently use Tandem, which has managed $60 million in bills so far.

“It provides you the expertise of a joint account with out truly having to have one,” Winterfield stated. “The whole lot you do need to share is in a single area, so it eliminates the back-and-forth. You can even settle up any balances at any time when you’re prepared.”

Buyers are additionally eager on the thought, just lately pumping $3.7 million into Tandem. Corazon Capital led the spherical and was joined by a bunch of particular person buyers and executives from firms together with OkCupid, Match Group and Tinder.

“I’ve not often seen customers love a product a lot, underscoring the necessity for revolutionary options for the fashionable couple,” stated Sam Yagan, co-founder and managing director of Corazon Capital, by way of e mail. “As a relationship professional, I’ve lengthy believed within the want for a product to assist {couples} navigate the distinctive challenges of managing their funds. Tandem stands out as a platform of reliability, belief and modernity and helps new and present relationships thrive financially and emotionally.”

Relationship targets

Tandem is just not alone in going after this drawback. We’ve beforehand reported on firms tailoring monetary providers to {couples}, like Plenty, Honeydue, Zeta, Ivella and Ensemble, which is for divorced individuals who co-parent.

Lots of Tandem’s opponents deal with offering a debit card to share bills, which Winterfield stated is usually a large step for people who find themselves simply beginning their monetary lives.

“We actually wished to construct this with the buyer in thoughts versus providing banking merchandise,” she stated. “We additionally wished to create a way more automated expertise that actually solves this ache level first for our core demographic.”

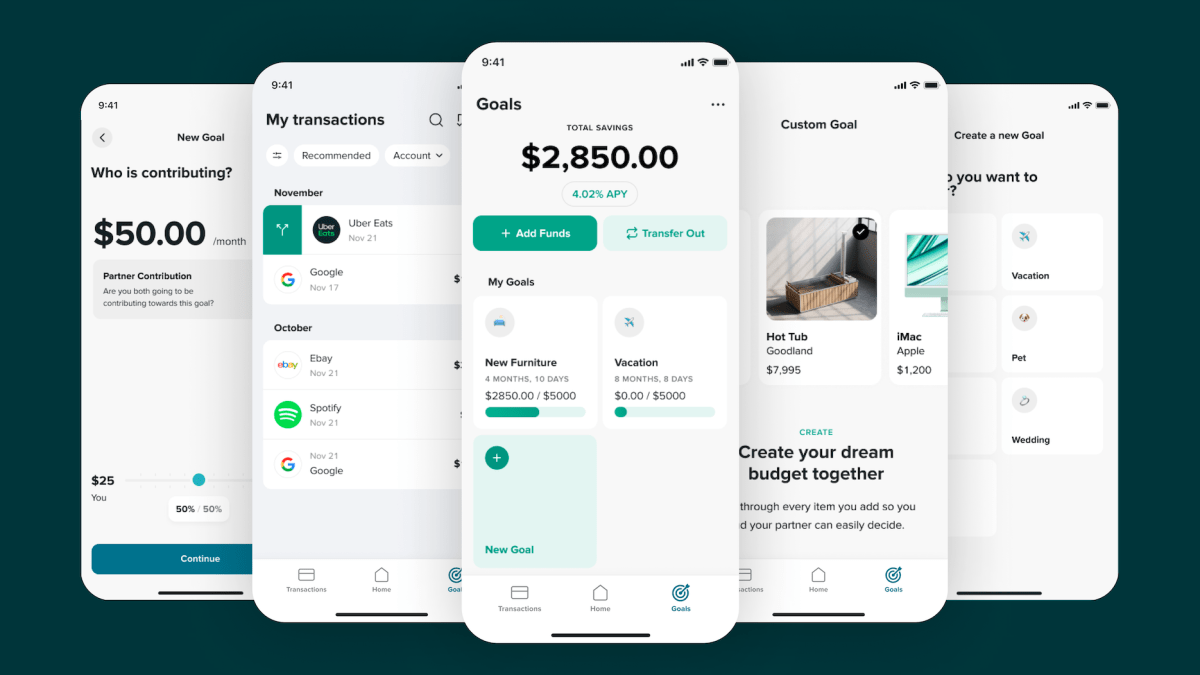

Tandem crowdsources its potential options from its person base, and a majority of customers impressed the following set of options referred to as “Objectives,” going stay this week. The Objectives characteristic is predicated on beginning a plan for shared purchases that each members of the couple will work on.

For instance, you set a objective collectively — shopping for new furnishings — and select how a lot every will contribute to that objective every month. Then every individual can pull in web sites or apps to seize varied merchandise so as to add to your targets so everyone seems to be on the identical web page and nobody individual looks like they’re doing it alone.

The brand new capital will go into launching this new characteristic, advertising and marketing and rising the group. As well as, an Android app is coming quickly.

Initially, Tandem launched with a “select your individual worth” mannequin. With the brand new characteristic now right here, the platform will go stay with a $10 per couple, per thirty days annual pricing or $12 per couple, per thirty days paying month-to-month.

“We need to construct one thing that integrates very seamlessly, permits you to share every thing in a really automated means with out truly having to take that subsequent step and join a joint card collectively,” Winterfield stated. “Tandem permits you to preserve that independence whereas additionally constructing a life collectively.”

Trending Merchandise