Aileen Lee is the founding father of Cowboy Ventures. She companions on the earliest levels with enterprise and consumer-oriented startup groups to construct merchandise clients love, and to assist groups construct aspirational firms. She has over twenty years of expertise beginning at seed stage and staying concerned for a few years past.

Allegra Simon loves working intently with unbelievable early-stage founders, cultivating the Cowboy neighborhood, and sporting many alternative hats as Chief of Employees to maintain the Cowboy ranch thriving. She works intently with Aileen on new enterprise diligence, portfolio assist, and every little thing else.

It’s been a decade since publishing “Welcome to the Unicorn Club,” so it’s a very good time to mirror on what’s occurred since.

In 2013, Cowboy Ventures had simply gotten began. To tell our funding technique, we assembled and studied a dataset of U.S.-based, VC-backed startups that had grown to be price greater than $1 billion inside 10 years, utilizing the time period “unicorn” as a shorthand to seize how magical these firms appeared.

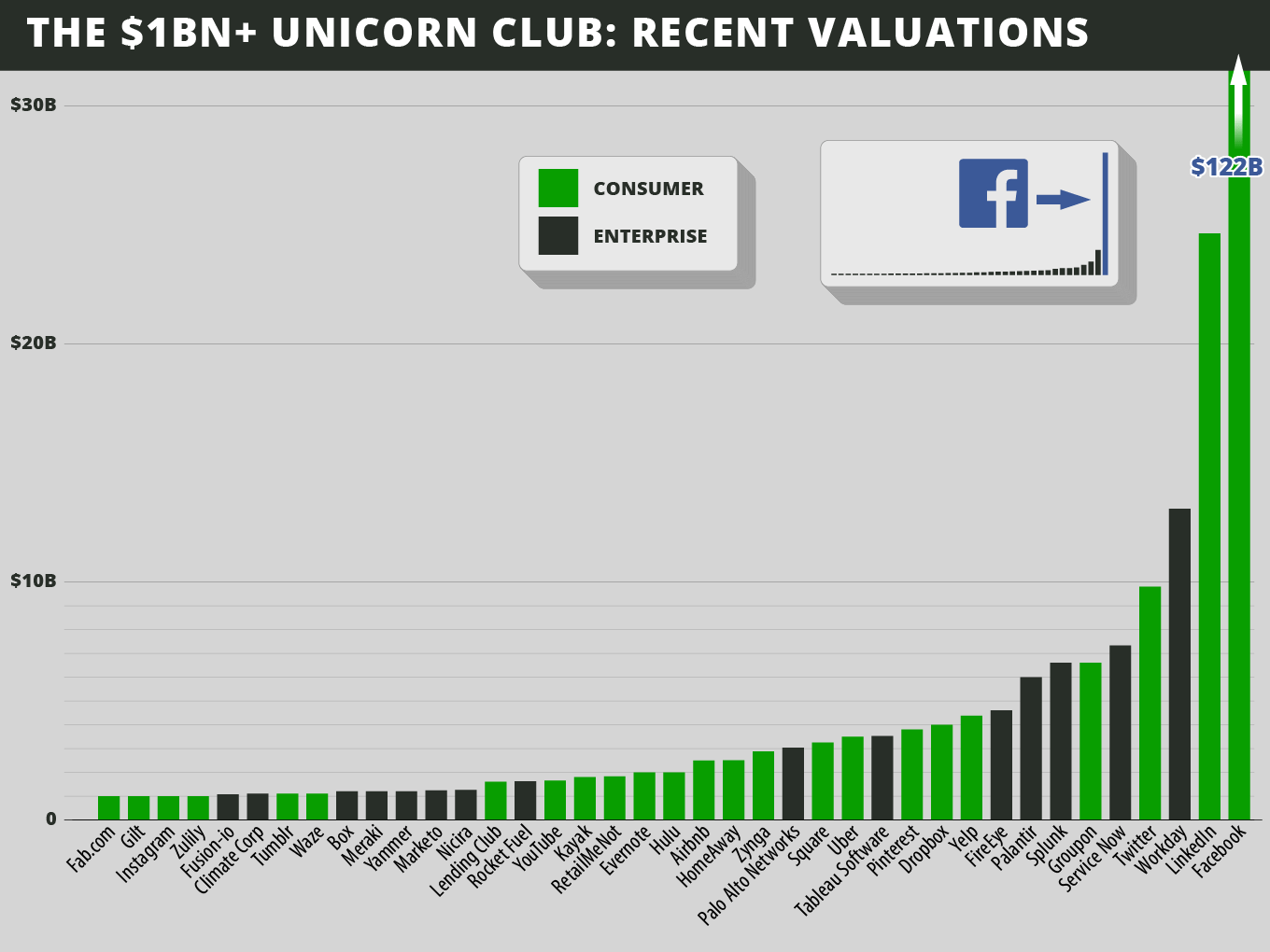

Probably the most profitable VC-backed U.S. tech firms lower than 10 years previous in 2013. Picture Credit: Cowboy Ventures

Our original analysis discovered solely 39 unicorns out of the hundreds of startups that had been based by then. Some highlights:

- The bulk (62%) had gone public or been acquired.

- The bulk have been consumer-oriented: round 60% of firms, making up 80% of the worth.

- Enterprise-oriented firms had 26x capital effectivity (present valuation divided by non-public capital raised), which was 2.4x higher than client firms.

- One firm grew to become a “superunicorn” (price greater than $100 billion) in that decade: Fb.

- Opposite to the prevailing stereotype, the typical age of a unicorn’s founder was 34; it was 38 for enterprise software program firms.

- The overwhelming majority of firms had three co-founders and customary work, college and tech expertise.

- The Bay Space was HQ to 70% of unicorns. New York, residence to a few, was the second-largest hub.

- There was little or no range: no feminine CEOs, and simply 5% of unicorns had a feminine co-founder.

2013 to 2021: A rising tide for VC funds, startups and valuations

Capital within the VC ecosystem tripled in a decade. Supply: NVCA Q3 2023 VC Monitor, NVCA 2022 Yearbook, Federal Reserve Financial Knowledge. Picture Credit: Cowboy Ventures

Historic returns, rising markets (together with social, cell, cloud, commerce safety, crypto and AI), COVID-era results and low rates of interest drove 3x extra capital ($580 billion extra!) into VC funds between 2013 and 2021 (and elevated VC payment earnings by greater than $11 billion).

This enabled established VC companies to lift record-breaking funds; public “crossover” funds joined the get together; and over a thousand newer firms additionally raised funds. The business gained hundreds of recent traders with recent checkbooks and restricted mentorship or oversight, given the tempo.

In 2021, it was an ideal storm of near-zero rates of interest and far of the world spending their days behind screens, more and more reliant on know-how for work and life. Due-diligence processes have been rushed, spherical sizes and valuations broke records, and a enormous herd of unicorns was topped.

The tide turns

Funding in non-public firms mirrored the Nasdaq climb. Supply: PitchBook-NVCA Enterprise Monitor, NVCA 2022 Yearbook, Federal Reserve Financial Knowledge. Picture Credit: Cowboy Ventures

In March 2022, the Fed raised charges, triggering a multiyear downward impact on public firms’ income multiples and enterprise software program companies’ budgets. Though huge VC companies continued to lift huge cash (64% of enterprise capital raised in 2022 went to funds bigger than $1 billion), traders principally froze their investments (round 40% of VCs stopped dealmaking in 2023). Firms refocused on margins and profitability, chopping prices in a number of waves. Unicorns began to fall by way of down rounds, public delistings and shutdowns.

However since 2013, there have been 532 firms that joined the Unicorn Membership. Much like our authentic evaluation, our 2023 dataset covers U.S.-based, VC-backed tech firms most just lately valued at greater than $1 billion in public or non-public markets and based in 2013 or later.

We use PitchBook, Crunchbase, Individuals Knowledge Labs, and information articles as sources however non-public market information is difficult. In the event you spot one thing inaccurate or we missed, please tell us at Cowboy Ventures.

To notice: Final-round valuations are an imperfect gauge, and so they probably inflate the present herd measurement and worth; Cerebral, Clubhouse and OpenSea could also be good examples. Utilizing the point-in-time methodology additionally leaves some firms out. For instance, Stripe was based in 2010, Zoom in 2011, and Snowflake and Coinbase in 2012. None of those was a unicorn in 2013 once we did the unique evaluation, and now they’re greater than 10 years previous, so that they’ve been excluded from this dataset.

Right here’s a quick take a look at our takeaways concerning the 532 firms within the 2023 Unicorn Membership. Learn on for a deeper dive into how issues have modified during the last 10 years:

- The variety of unicorns ballooned 14x up to now decade, from 39 to 532! They now serve a wider array of sectors (we’re monitoring 19), from local weather and crypto to vertical SaaS.

- The pendulum swung arduous to enterprise, with 78% of unicorns in the present day centered on B2B, the inverse of 2013.

- Nonetheless, it’s a wobbly, bloated herd that may skinny within the coming years (more likely to about 350) as a result of . . .

- A whopping 93% are “papercorns”: privately valued firms.

- 60% are “ZIRPicorns”: Their final valuations have been from 2020–2022, when rates of interest have been close to zero, and lots of of those are working out of runway.

- Round 201% of unicorns are on the cusp, valued at nearly $1 billion.

- Round 40% are buying and selling at lower than $1 billion within the secondary markets.

- BUT, there may be numerous substance on this herd. And we see proof of a Software program Unicorn Energy Regulation: The U.S. will likely be residence to greater than 1,000 unicorns by 2033.

- There have been only a few exits. Solely 7% (35 firms) versus 66% a decade in the past.

- Capital effectivity declined considerably. This will likely be dangerous for exits, enterprise returns, founders and staff.

- OpenAI will probably be the primary superunicorn of the last decade, and AI probably the mega-trend.

- The Bay Space was residence to extra unicorns this time round however misplaced share as different hubs grew.

- Extra unicorns means extra founders, however some issues didn’t change in any respect.

- Range remains to be needed, and there’s loads of alternative to enhance the composition of founding groups.

- If the previous is a prologue, count on a blended outlook for the present herd and lots of extra unicorns sooner or later.

A deeper dive on the place we’re in the present day

Unicorns ballooned 14x up to now decade

This herd is price a staggering $1.5 trillion in mixture worth (versus $260 billion in 2013). However changing into a unicorn remains to be not simply accomplished: Lower than 1% of VC-backed startups go on to grow to be price greater than $1 billion. A perfect candidate is 5 instances extra more likely to get into Stanford, Harvard or MIT than to discovered a unicorn.

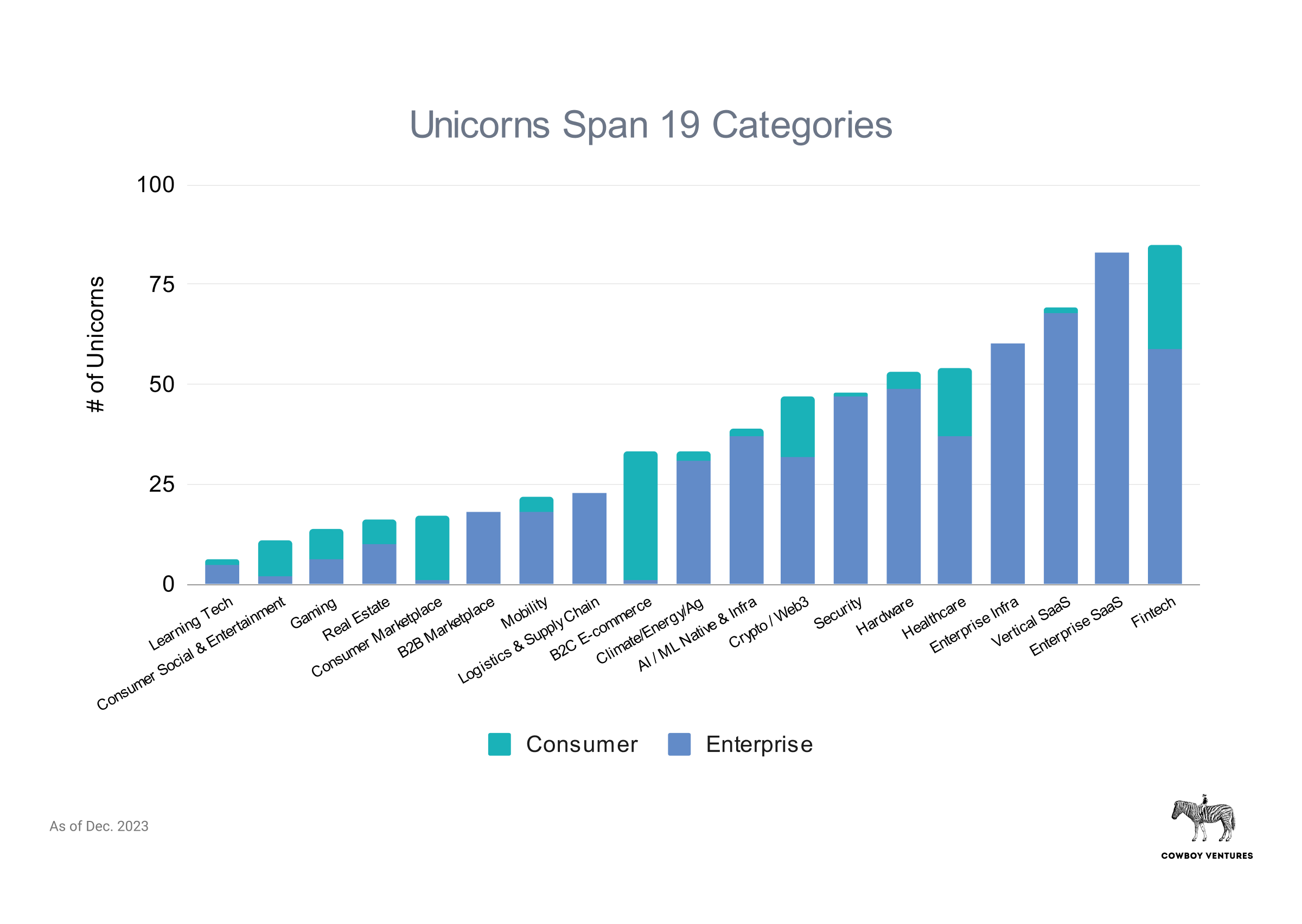

Unicorns in 2023 innovate throughout an array of sectors. Picture Credit: Cowboy Ventures

Unicorns now additionally span a wider array of sectors (we’re monitoring 19!). Most of those sectors weren’t on our 2013 listing (social, commerce and normal enterprise dominated again then). Click on the gallery under to be taught extra about essentially the most precious firms in every sector.

Probably the most precious firms are in very totally different sectors in comparison with 2013.

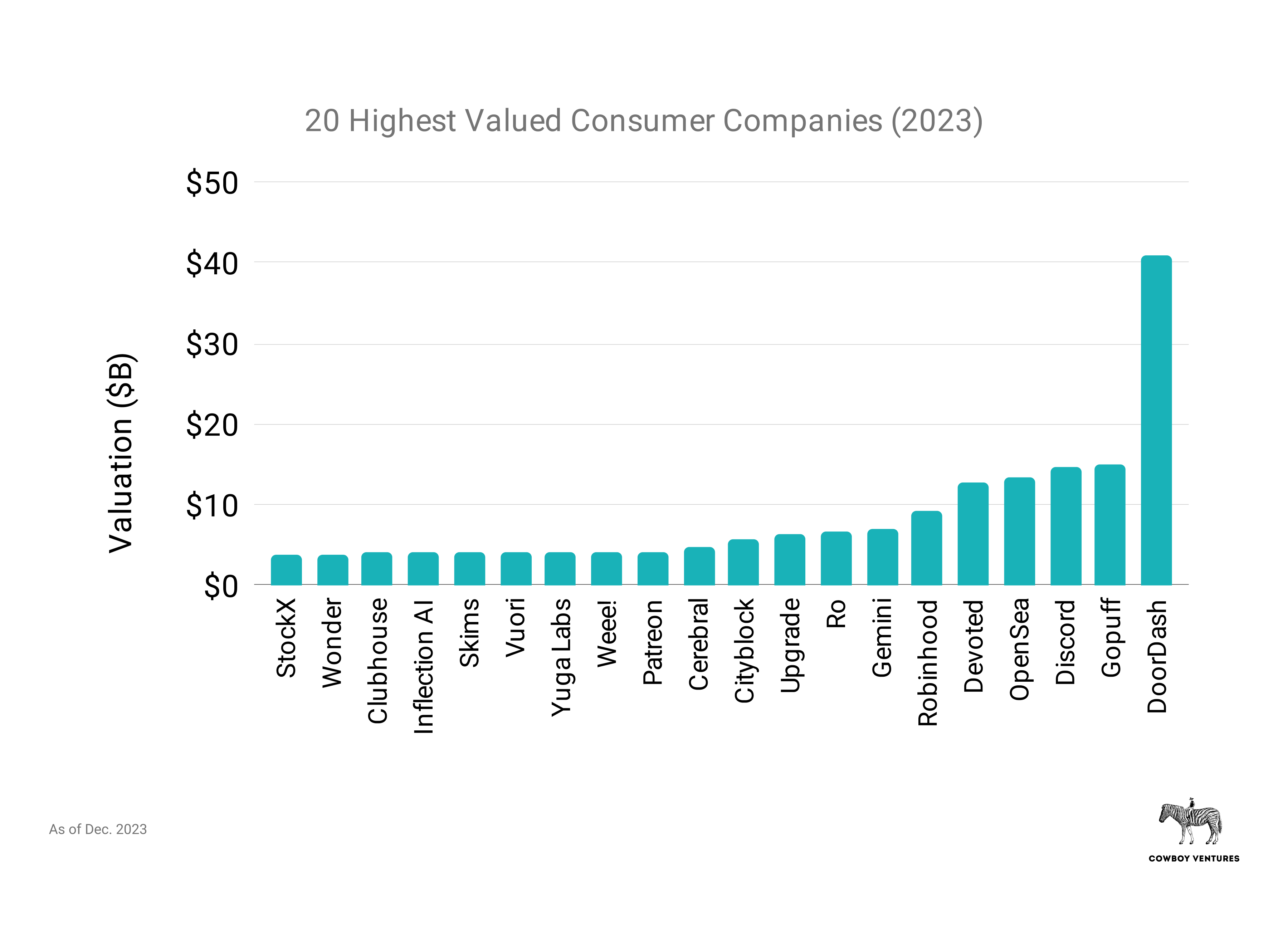

Probably the most precious unicorns in 2023 have innovated throughout a large spectrum that stretches from normal AI and healthcare to meals supply, HR software program and inventory buying and selling. That marks an enormous departure from the sectors on the 2013 listing. As beforehand famous, last-round valuation is an imperfect gauge: 75% of the “unexited” firms on this high 20 listing have been final valued in 2022 or earlier.

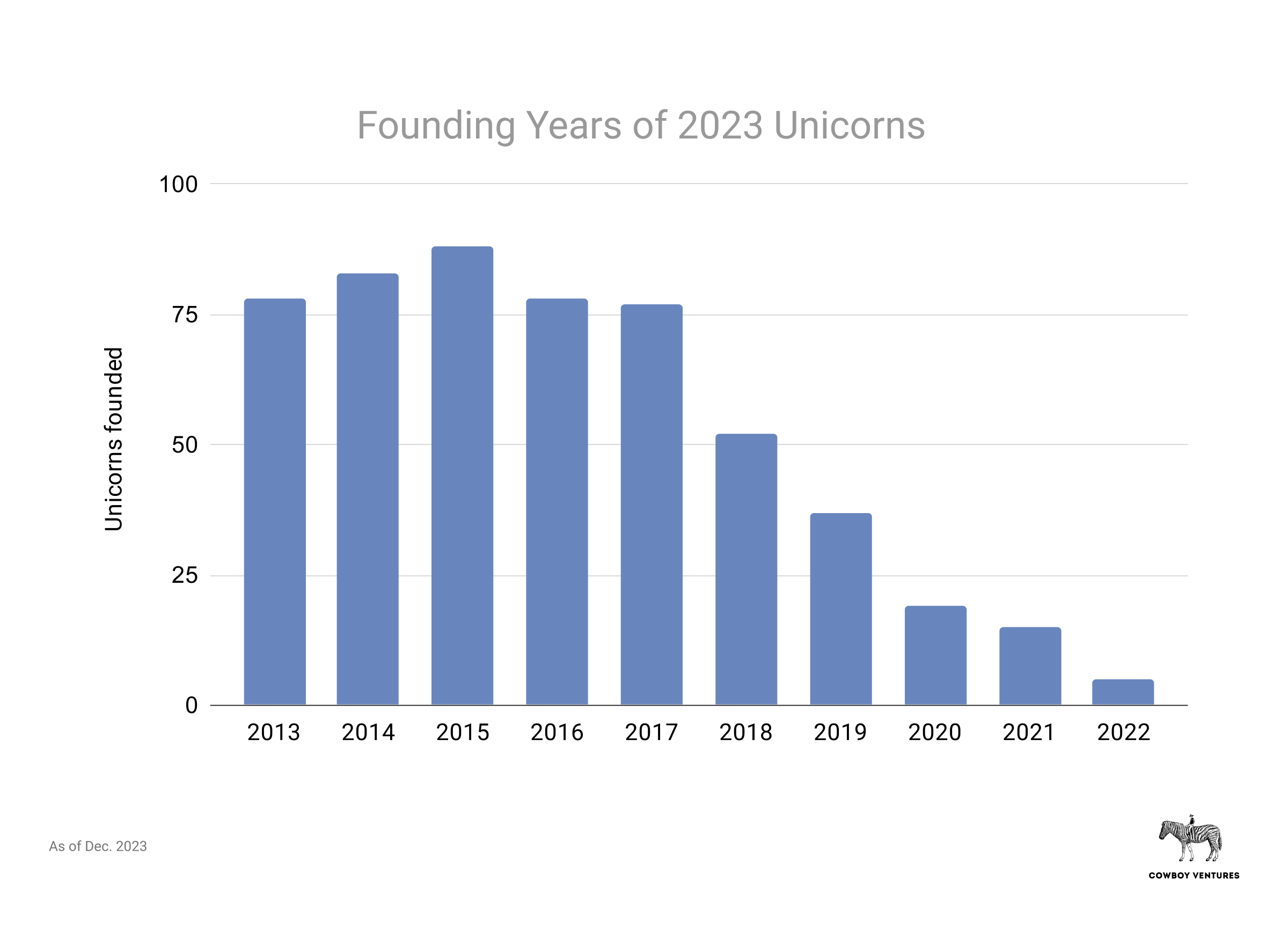

Firms of all ages grew to become unicorns within the run-up. Picture Credit: Cowboy Ventures

Not like in our 2013 evaluation, there have been no finest years for founding a unicorn: 2020 and 2021 accelerated the “crowning” of all ages and levels of firms. Right now’s unicorns are seven years previous on common, identical as a decade in the past, which looks like a very good factor.

We don’t analyze fallen unicorns right here. However anecdotally, we see being topped a unicorn too rapidly may very well be a curse. Fallen unicorns like Hopin and Bird have been topped inside one 12 months of founding; automotive leaser Fair in two years; and Convoy and Knotel simply three years after founding.

The pendulum swung arduous to enterprise

Enterprise firms are price $1.2 trillion, 80% of mixture worth. Picture Credit: Cowboy Ventures

Ten years in the past, we discovered simply 15 (38%) unicorns constructing B2B software program and providers comprising simply $55 billion in complete worth. Workday, ServiceNow, Splunk and Palantir have been essentially the most precious enterprise unicorns on the time.

Right now, there are 416 enterprise unicorns — making up round 78% of the listing — price $1.2 trillion and driving 80% of mixture worth (versus 20% in 2013).

Client firms comprise 20% of our listing. Picture Credit: Cowboy Ventures

Client firms in the present day make up 20% of mixture worth, an enormous distinction to the 80% they accounted for again in 2013. Bear in mind “SoMoCo”? Social (Facebook, Twitter, Pinterest), cell (Uber, Square) and e-commerce (Groupon, Gilt, Fab).

Probably the most precious client startups in the present day function in areas like last-mile supply (DoorDash, Gopuff), well being (Devoted, Ro, Cityblock), and gaming-driven platforms (Discord, Rec Room) — firms that drove new habits throughout COVID.

What brought on a lot capital to flock to enterprise firms up to now decade? The attraction of historic capital effectivity, the predictability of SaaS enterprise fashions (excessive gross margin and buyer retention), and a rising variety of extremely valued potential acquirers have been probably an enormous draw. International adoption of cloud made it simpler to undertake new software program and opened an enormous window for a complete new ecosystem of software layer, infrastructure, information and analytics, and safety firms.

The cyclical pendulum does swing, so given the arduous shift to enterprise, we hope and count on extra thrilling client unicorns will likely be born in coming years. For inspiration, lots of in the present day’s main client web experiences are about twenty years previous (eBay, Expedia, OpenTable, Tripadvisor, StubHub, Yelp), presumably fertile territory?

A bloated herd

Our 532 firms are a wobbly, bloated herd that may skinny within the coming years to round 350. That’s as a result of a whopping 93% of unicorns are literally “papercorns”: privately valued on paper however not but “liquid.” It’s an enormous change from simply 36% non-public unicorns in 2013.

A spate of ZIRPicorns was topped when charges troughed. Sources: PitchBook, Federal Reserve Financial Knowledge. Notice this consists of all VC-backed firms valued at $1 billion for the primary time in a given 12 months, together with these based earlier than 2013. Picture Credit: Cowboy Ventures

Sixty p.c of unicorns in the present day are what we name “ZIRPicorns”: They have been final valued between January 2020 and March 2022, which noticed peak public multiples and near-zero rates of interest.

When cash was flowing, unprofitable non-public firms have been typically in a position to elevate sufficient to fund two to 5 years of operations. Because of this working runways are getting brief for a lot of unicorns. Many are working to get worthwhile on current money, which is difficult given the present financial system and is even tougher when beginning with a decrease gross margin enterprise.

Given the chilly current M&A environment, founders’ resistance to recapitalization, and traders’ concern of “catching a falling knife” by investing in a down spherical, we count on extra abrupt shutdowns in 2024 (e.g., Convoy, Olive Health, Zume) (“unicorpses,” anybody?).

Valuations skew decrease on this herd, and lots of are on the cusp of being a unicorn. Picture Credit: Cowboy Ventures

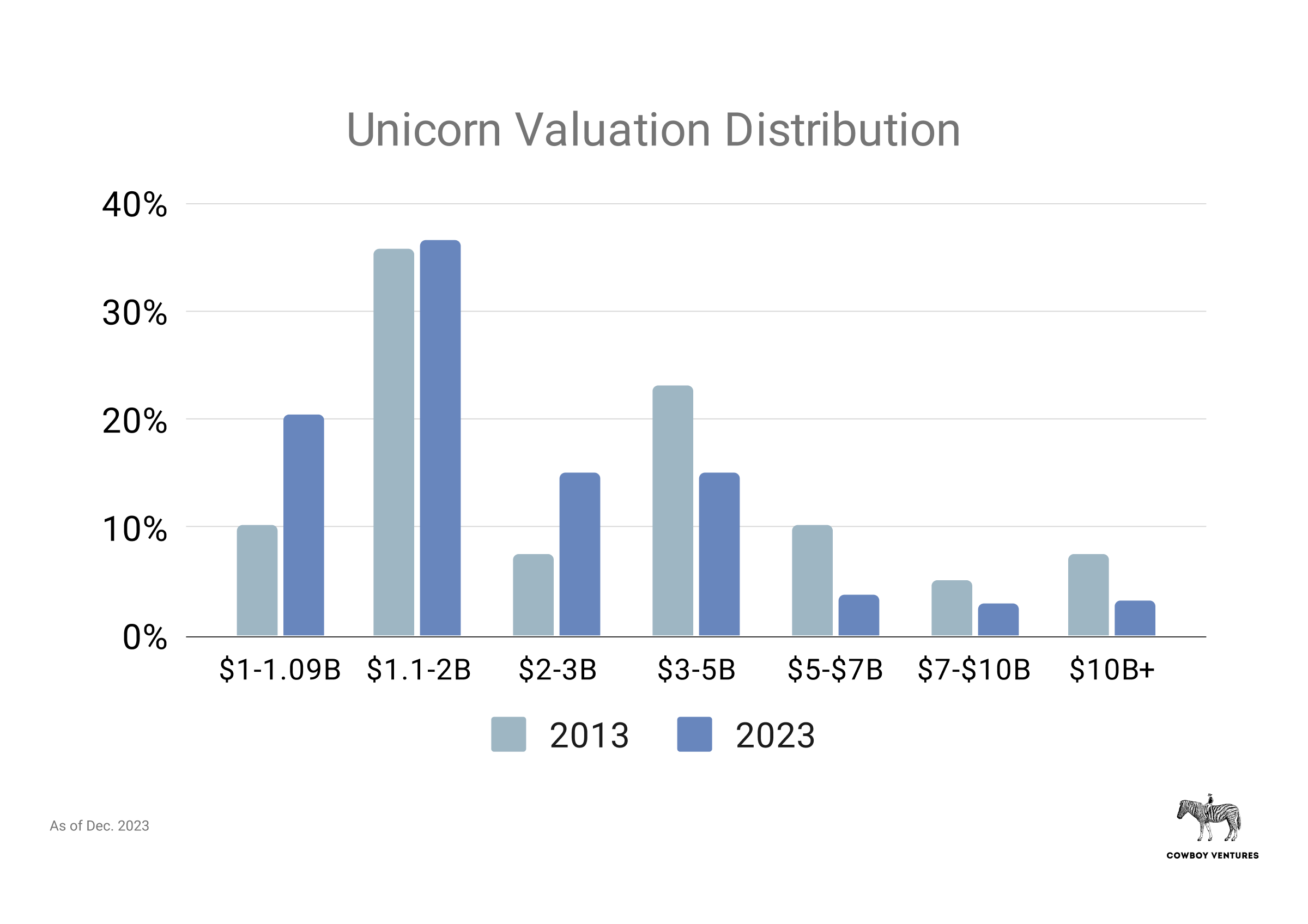

Coining the time period additionally appears to have affected the market (sorry!): 21% are valued at $1 billion (versus 10% in 2013), on the cusp of being a “unicorn,” and 46% at lower than $2 billion.

Round 40% are buying and selling under the $1 billion valuation mark in secondary markets, in keeping with actual order information for 290 unicorns on our listing from Hiive. It’s doable extra may commerce at lower than $1 billion.

On the brilliant facet, we see roughly 350 wholesome companies of substance on this herd — virtually 10x in a decade! Many ZIRPicorns and papercorns raised sufficient capital and are efficiently navigating the brand new local weather, and can develop into and past their present valuations. Many will grow to be public firms within the coming years, with rock-solid financials, examined by the downturn. And some of those firms will develop to grow to be superunicorns.

And, we see proof of a Software program Unicorn Energy Regulation.

An echo of Moore’s legislation? Unicorn development tracks compute energy development. Supply: Our World In Knowledge, plus PitchBook’s listing of complete U.S.-based non-public unicorns (together with these based earlier than 2013). Notice this chart is for illustrative functions. Picture Credit: Cowboy Ventures

The variety of unicorns elevated at an incredible 30% on common yearly up to now decade, spurred by enterprise software spend, client tech adoption, VC funding and rates of interest.

Picture Credit: Cowboy Ventures

We see an echo of Moore’s legislation right here: As compute capability, functionality and utilization improve, the variety of unicorns will increase. The present momentum in AI ought to add gas to innovation and demand.

Adjusting the present herd to 350, future unicorn development to a much less bubbly 15%, and enhancing present capital effectivity a bit, we see 4x extra, or about 1,400 U.S. unicorns, in 2033. Counterarguments to this line of pondering embrace scarcer enterprise capital, greater rates of interest and software program consolidation. However earlier downturns have been fertile for unicorn founding. This will likely be thrilling for the way forward for innovation, jobs and the tech financial system, regardless of present situations.

The unique “liquid unicorn” membership

There have been few exits: solely 7% versus 66% within the prior decade. Simply 35 of 532 unicorns are public or have been acquired for over $1 billion, a consequence of elevated non-public capital and a tougher regulatory and M&A setting. The common time from founding to an IPO or acquisition was a speedy six years, and a powerful 75% of founding CEOs led their firms from founding by an exit.

Simply 14 of 532 unicorns are public in the present day. Picture Credit: Cowboy Ventures

The general public unicorn membership is elite, with simply 3% public in comparison with 41% going public the last decade prior. That’s an enormous change, partly pushed by the supply of a lot non-public capital and traders prepared to spend money on richer-than-public valuations within the final decade.

These firms are break up between enterprise and client and span a wide selection of sectors.

It’s additionally notable that round 70% of the present public unicorns’ CEOs have been the founding CEOs. So many leaders scaling from being a startup founder and particular person contributor to main and managing a multi-billion-dollar public firm is spectacular!

Only a pattern of formicorns’ battle in public markets, many spurred by SPACs. Picture Credit: Cowboy Ventures

Reflecting the instances, there are extra fallen public unicorns than wholesome public unicorns on this herd. At the least 20 unicorns went public within the final decade, then fell under $1 billion in worth (howdy, SPACs), versus simply 14 present public unicorns. (These, and firms beforehand valued at lower than $1 billion however subsequently acquired or recapitalized at a decrease valuation, aren’t included in our evaluation.)

A paltry 4% of 2023 unicorns had an “exit” by way of acquisition vs. 23% in 2013. Picture Credit: Cowboy Ventures

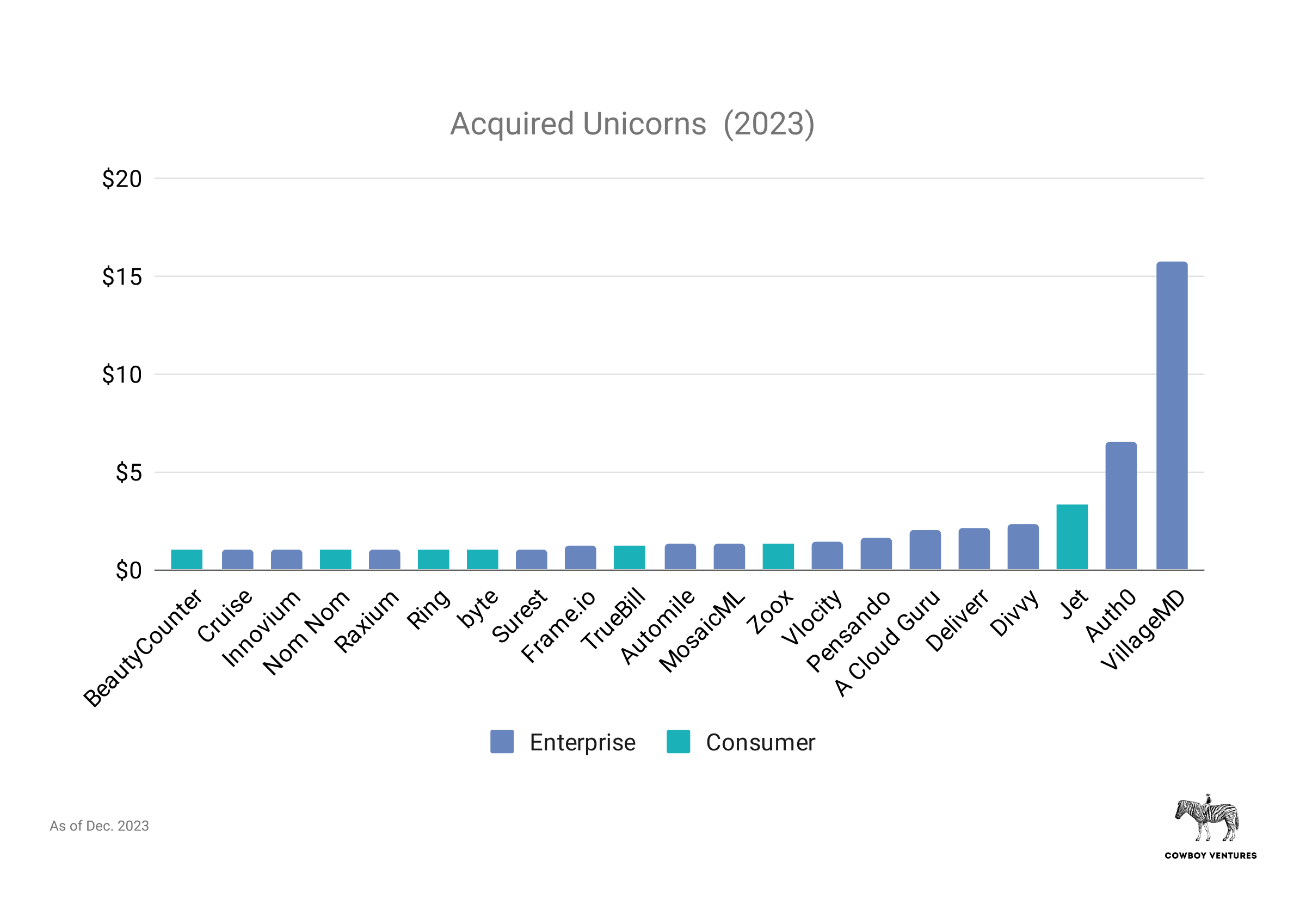

Simply 21 firms have been acquired, spanning a various set of sectors: Two-thirds have been in enterprise and the remaining client. The common acquisition value was $2.4 billion, about 2x that of 2013. Notably, 33% of those offers concerned {hardware} firms (Cruise, Raxium, Ring, Zoox, and so forth.), probably a consequence of low rates of interest for each unicorns and acquirers.

Capital effectivity declined considerably

Unicorn capital effectivity dropped considerably during the last 10 years — precipitously for enterprise firms. This will likely be dangerous for exits, enterprise returns, founders and staff.

Capital effectivity plummeted amongst enterprise unicorns. Picture Credit: Cowboy Ventures

Probably the most profitable VC-backed tech firms have traditionally delivered outsized returns. Delivering a 26x return inside 10 years is excellent (about 40% IRR), however traders (and expertise) need to threat years of illiquidity versus different asset lessons or industries.

Previously decade, tech has misplaced its capital effectivity edge. Enterprise firms’ previously spectacular capital effectivity of 26x plummeted to 7x, placing it consistent with client firms’ effectivity (regardless of usually greater margins and buyer retention), which additionally dropped from 11x to 7x. Provided that many unicorns are presently overvalued, even 7x is probably going inflated.

In different phrases, traders would have been higher off investing in public superunicorns like Salesforce, Amazon, and Microsoft (up 8x, 9x, and 9x, respectively) than in lots of firms in our present unicorn herd.

Let’s use an instance for instance capital effectivity as we outline it: present valuation divided by non-public capital raised.

- Let’s say an organization has raised $600 million in most popular inventory rounds plus $100 million in debt.

- With sturdy buyer traction and a magnetic CEO, in 2021 the corporate grows to run-rate income of $100 million and raises capital at a $3 billion valuation, mirroring the 30x multiples of high-growth public comparable firms.

- Workers get widespread choices at 50% the popular value — a $1.5 billion valuation.

- Then comes 2022. Churn skyrockets and new gross sales dry up. The corporate reduces its headcount from 1,000 to 500 over a number of waves of layoffs. The crew fights like hell and will get again to $100 million ARR by 2025, and virtually reaches breakeven.

- In 2025, the corporate is obtainable a $500 million acquisition provide by a personal fairness agency, or 5x its income, the present public market comparable.

- The administration takes the deal, agreeing to an 8% “carveout” for themselves ($20 million) and staff ($20 tens of millions) as inventory choices are “underwater.” Debtors receives a commission in full, traders get about 60% of their funding again, and staff who stick with the corporate get about $30,000 at exit after 4 to 10 years of labor.

- The corporate’s capital effectivity is 0.83x ($500 million/$600 million fairness raised).

Rates of interest once more had a huge impact right here: As charges fell, traders maintained confidence in historic enterprise returns, whereas competitors grew for allocation in scorching offers. This brought on many to miss valuations, enterprise mannequin margins, payback durations and burn charges as they invested.

For the startup business to as soon as once more ship outsized returns, now we have to regain capital effectivity self-discipline.

Shoutouts to extremely capital environment friendly firms (with caveats). Picture Credit: Cowboy Ventures

The above chart highlights extremely capital-efficient firms, with caveats. The overwhelming majority of those are “papercorns,” so this listing doesn’t mirror realized capital effectivity. Cruise’s effectivity is predicated on its $1 billion acquisition by GM in 2016 after being based in 2014. The corporate has raised billions extra since as a GM subsidiary, which paints a really totally different image of its present effectivity.

In our 2013 evaluation, Workday and ServiceNow have been standouts, with capital effectivity of 60x every. Their market caps are additionally 5x and 19x greater now, respectively.

Some 2023 unicorns are presently price <2x capital raised. Picture Credit: Cowboy Ventures

In the event you’re in search of proof that firms raised an excessive amount of up to now decade, about 20% of firms on our listing are price lower than 4x their capital raised. Given what number of are probably overvalued, actuality will probably be worse than this. The classes with the bottom common capital effectivity have been local weather/power, actual property, and healthcare.

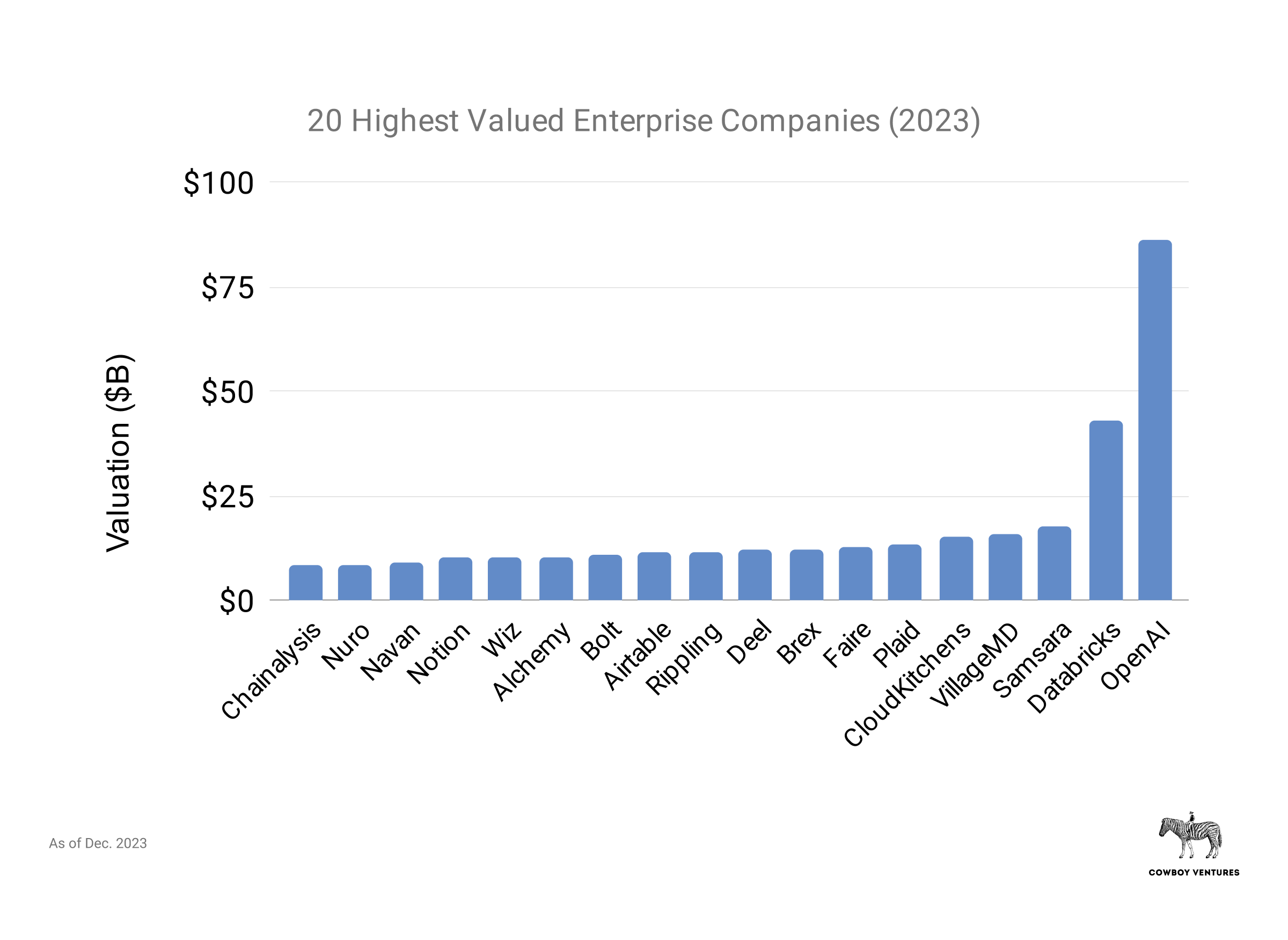

OpenAI is more likely to grow to be the last decade’s superunicorn, and AI the megatrend

The earlier main waves of tech innovation have every topped a superunicorn that grows to be price greater than $100 billion over time, like Microsoft, Cisco, Amazon, and Meta. (Meta is the one one to be topped inside the final 10 years.)

OpenAI is near being the primary AI superunicorn, rumored to be elevating at a valuation of greater than $100 billion, at simply eight years previous.

At instances over the previous 10 years, crypto appeared prefer it may very well be the mega-trend of the last decade. Coinbase hit a market cap of $76 billion in November 2021 after going public months earlier; it’s now price about $32 billion (as a result of Coinbase was based in 2012, it isn’t included on this dataset).

Superunicorns grew superpowers, 2013–2023. Picture Credit: Cowboy Ventures

There are actually 15 VC-backed superunicorns, and so they obtained much more precious during the last decade. Meta was price $122 billion in 2013 and is price about $950 billion, or 8x, in the present day.

Superunicorns have superpowers that assist create and/or disrupt complete classes — like Netflix (price greater than Comcast, Paramount, and Warner Bros. mixed) and Tesla (price greater than the following 5 largest public automakers mixed).

Of our authentic dataset, three extra grew to become superunicorns in recent times: ServiceNow, Uber, and Palo Alto Networks. And Airbnb is on the horizon at $88 billion. They’ve grown to be price greater than Hyatt and Marriott mixed and take pleasure in community results.

Superunicorn energy could compound additional within the coming years, with software program consolidation and tighter capital constraints for smaller-scale gamers.

The herd spreads past the Bay

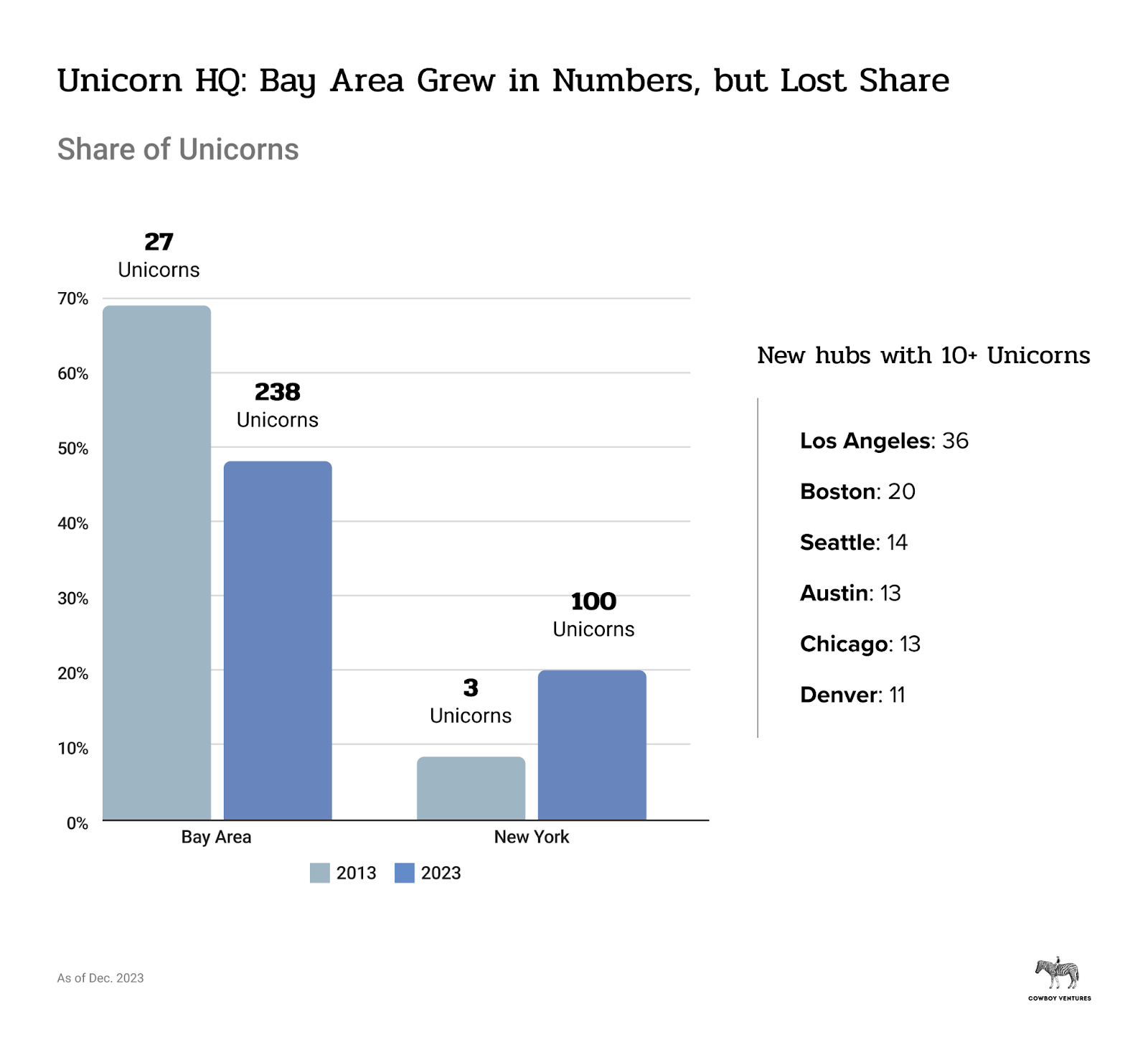

The Bay Space gained in numbers however misplaced floor as the house of unicorns as different hubs grew.

COVID results probably helped unfold extra unicorns throughout the nation. Picture Credit: Cowboy Ventures

The importance of geography continues to evolve, given COVID-era results. Many unicorns are actually unfold throughout a number of cities and provide a hybrid work setting to staff. Notably, no less than 22 have no physical HQ office, in keeping with Flex Index information. However there are clear financial and native community results to geographical unicorn hubs. Many CEOs cite productiveness, creativity and cultural good points from in-person work, related for hopeful future unicorns.

The Bay Space remains to be the biggest unicorn pasture, but it surely misplaced loads of floor, from being residence to 69% of unicorns in 2013 to 45% in 2023. On the brilliant facet, it’s residence to 238 unicorns (together with the 4 most dear: OpenAI, Databricks, DoorDash, and Samsara), 9x greater than in 2013.

It’s unclear whether or not the Bay Space will regain its stature as unicorn central. Rather a lot could depend upon return-to-work insurance policies, the significance and focus of AI expertise, and the standard and price of residing in comparison with different hubs, in addition to the following era of unicorns.

New York’s share grew so much (11% to 19%) because the second-largest hub. The town is now residence to 100 unicorns (about 40% are crypto/web3 or fintech, together with OpenSea and Chainalysis).

Many geographies grew from having no or few unicorns to changing into HQ to greater than 10: Los Angeles (CloudKitchens, Blockdaemon); Boston (Devoted Well being, Circle); Seattle (Auth0, Outreach); Austin (Everlywell, Workrise); Chicago (VillageMD, Tegus); and Denver (Guild, Crusoe).

Extra unicorns, extra founders! However some issues didn’t change in any respect

Extra unicorns unfold throughout extra geographies, and founders now hail from a broader number of backgrounds. Utilizing publicly out there info and information from People Data Labs, our listing grew to greater than 1,300 founders versus round 100 in 2013.

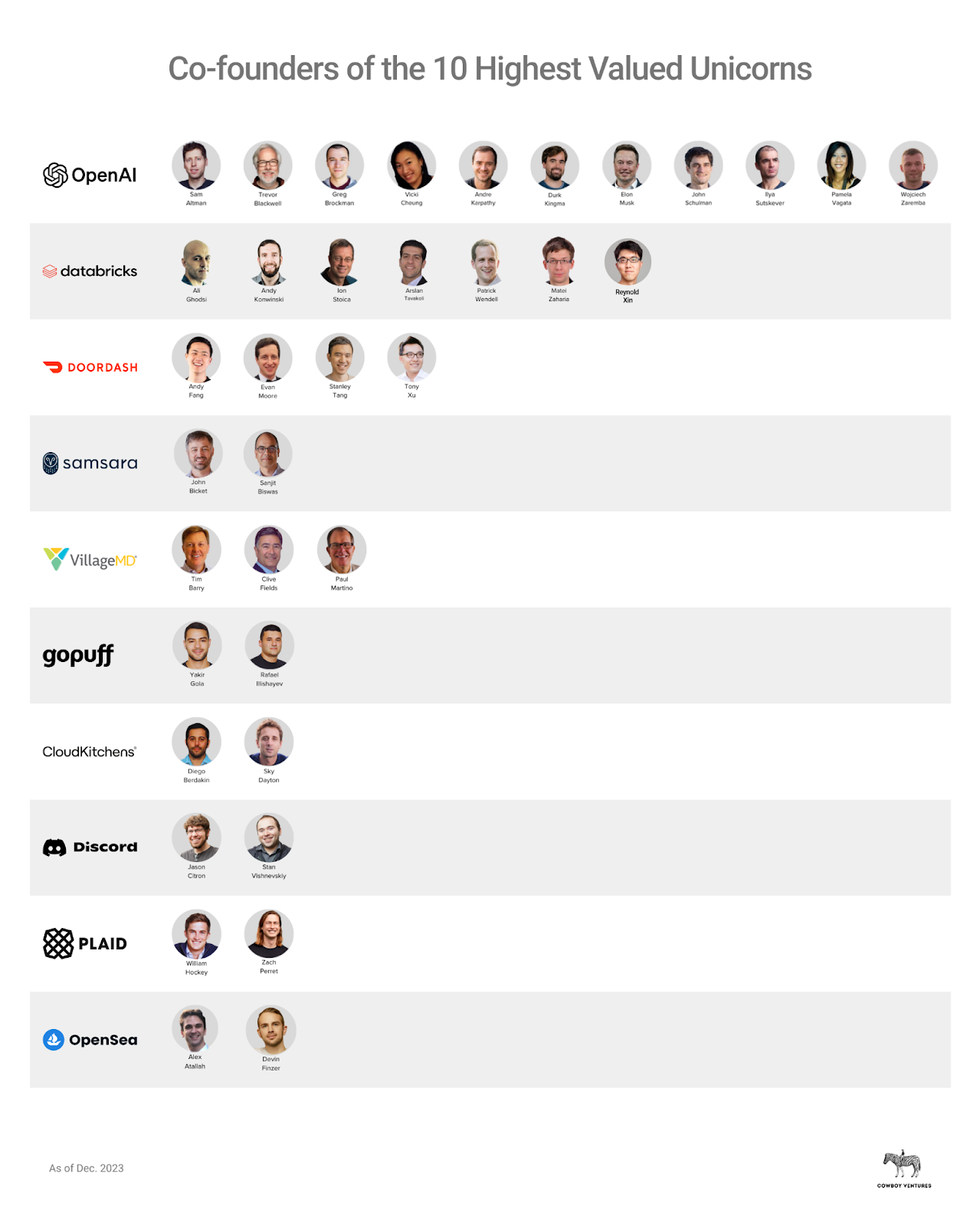

Discover what most of those founders have in widespread? Picture Credit: Cowboy Ventures

Eighty-three p.c of unicorns within the final decade had co-founders (versus 90% in 2013). On common, firms had three co-founders — identical as 10 years in the past. The common age at founding was 35, one 12 months older than 2013. Twenty-somethings and faculty dropouts are nonetheless outliers.

About 70% of founders labored beforehand in tech, similar to our 2013 information.

Round 65% of founders went to highschool or labored collectively (a lower from 90% in 2013), and 67% of groups have a co-founder with founder expertise of some form (versus 80%). Prior pursuits ranged from founding a small tutoring biz, to Jet.com and Twitch, to a fallen unicorn like WeWork.

Picture Credit: Cowboy Ventures

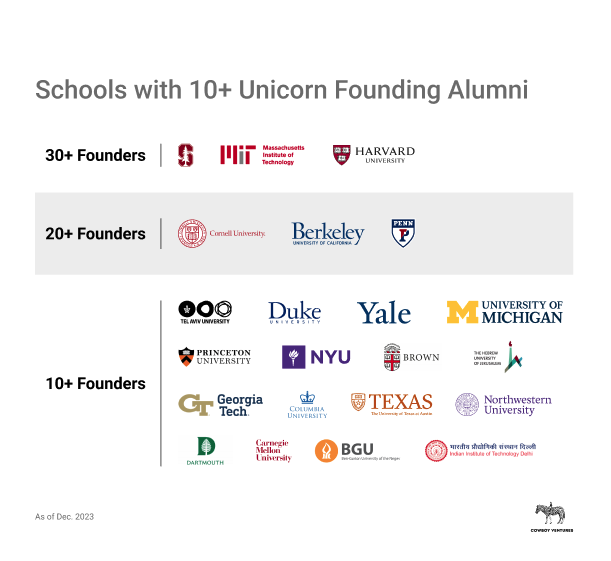

However founders’ instructional and work backgrounds are far more various in the present day. Solely about 20% of founders went to a “high 10 college” (as outlined by U.S. Information & World Report) in comparison with two-thirds in 2013. No college has greater than 5% “market share.” Stanford nonetheless leads because the alma mater of 5%, however accounts for a lot lower than the 33% it did in 2013.

About 40% of co-founders are “non-technical” by schooling, bucking the “founders should be technical” stereotype. Twenty-five p.c majored in enterprise and 15% within the humanities, whereas 60% majored in a STEAM discipline. In 2013, 90% of CEOs had technical levels, an enormous change. Based on Individuals Knowledge Labs, simply round a 3rd of founders beforehand held software program engineering roles.

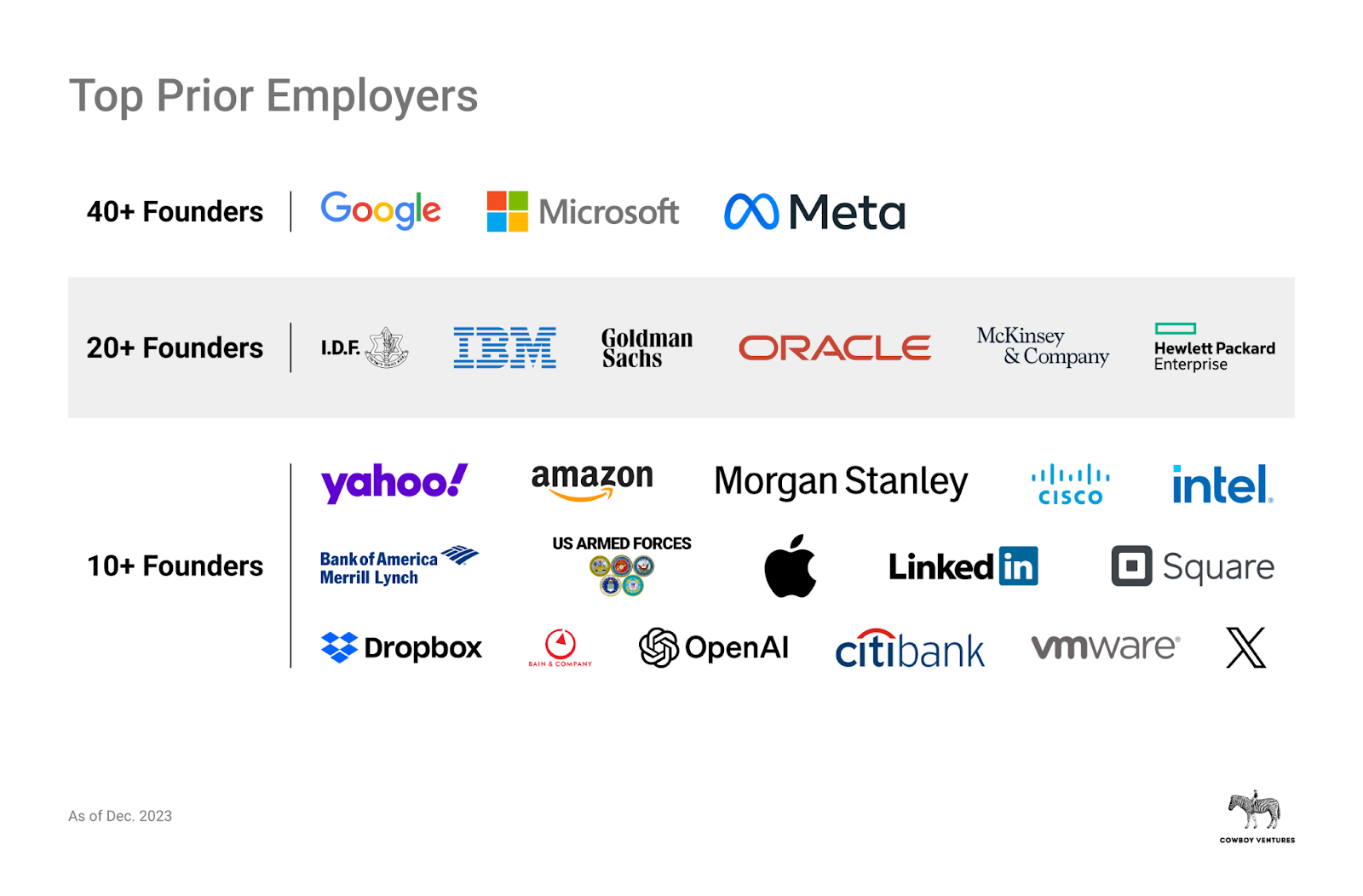

Prior employers embrace superunicorns, banking, consulting and navy. Picture Credit: Cowboy Ventures

A surprisingly excessive 20% of co-founders beforehand labored at a superunicorn, probably tied to the truth that 70% of co-founders in the present day have labored beforehand in tech. Google leads as the highest breeding floor for unicorn founders: We discovered 87 with work expertise at Google, which is about 6% of co-founders.

Range has numerous room for enchancment

As unicorns proliferated, co-founders’ geographies, schooling and work backgrounds did, too. That is thrilling information for future founders.

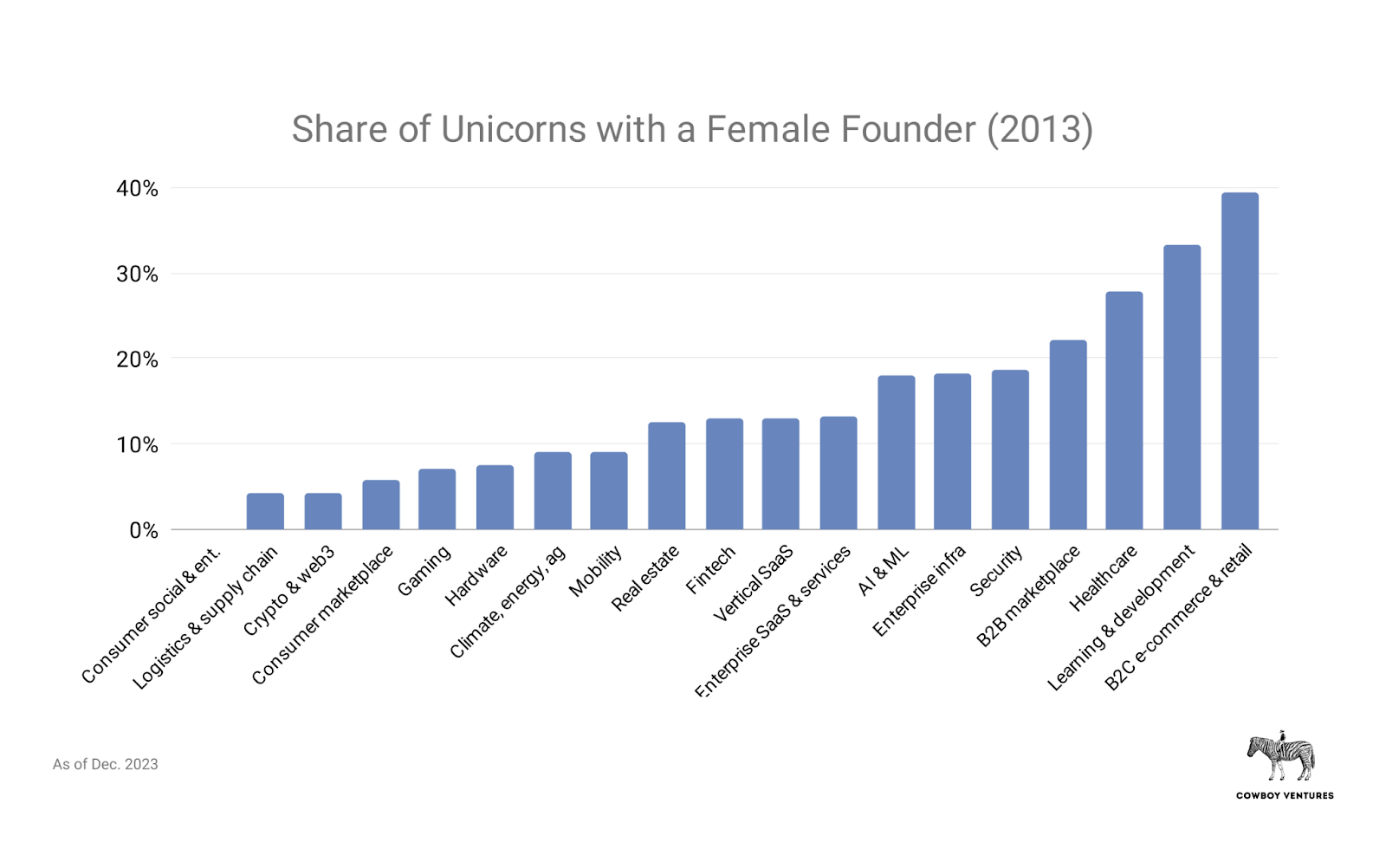

Enchancment has been sluggish on the subject of co-founder gender range: Simply 14% of unicorns now have a feminine co-founder (versus 5% in 2013), and 5% have a feminine founding CEO (in comparison with none in 2013).

These numbers are nonetheless fairly pathetic: There are extra founders named Michael, David and Andrew than there are ladies CEOs of unicorns. At this price, we gained’t attain equal gender illustration till 2063.

Some sectors have extra gender range on the high vs. others. Picture Credit: Cowboy Ventures

It’s difficult to trace different points of id like race or whether or not the particular person is a member of the LGBTQ+ neighborhood. Myriad studies present various groups ship higher outcomes, together with in downturns, so enhancing range given the harder instances looks like a no brainer.

Living proof: The elite public unicorn membership has greater gender range on the high: 14% have feminine CEOs (two) and 21% have feminine co-founders (three).

Wanting forward: The subsequent 10 years

If the previous is a prologue, count on change forward for this herd of unicorns and a really totally different, a lot bigger listing in 2033. Numbers, sectors, and founder backgrounds modified a lot this previous decade.

Our authentic 39 had blended fates. About half are presently public firms and round 80% are price extra in the present day. Three extra grew to become superunicorns (ServiceNow, Palo Alto Networks and Uber), and community impact firms (we love community results!) additionally grew stronger (Uber + Airbnb + LinkedIn = worth of entire authentic listing).

Enterprise firms fared extra reliably, growing 6x in worth since 2013. All however one (Rocket Gas) maintained unicorn standing by the second decade. So client firms had bumpier journeys. Thirty-three p.c are smaller in the present day (Lending Membership, Yelp), and a few have had hearth gross sales or shut down (Tumblr, Zulily).

The scale, scale and variety of VC companies may even change within the coming years. In 2013, there have been about 850 energetic enterprise funds. Right now there are about 2,500. As unicorns fall out of the dataset, we count on extra change in VC firms. Some VCs will retire, some will elevate smaller funds (right-sized for higher returns), downsize groups, or fold. Given the probability of decrease returns from many papercorns on this herd, change appears inevitable. We’ve seen “VC musical chairs” in earlier cycles, and it’s occurring once more.

As famous in our original post, multi-billion-dollar VC funds want multi-billion-dollar outcomes to ship acceptable returns. As funds obtained larger, their incentives modified and drove spherical sizes and valuations greater, with some damaging penalties. We don’t count on VC companies to return to 2013 in employees or AUM. However the classes right here ought to give founders, VCs and LPs numerous warning about an excessive amount of cash, too early and too quick — and from whom.

That stated, regardless of the sins of the previous decade, know-how continues to vary our world. Founders have entry to extra inspiration, position fashions, capital and expertise than ever. Unicorns are nonetheless comparatively few and small versus the variety of a lot bigger, slower-moving firms with outdated know-how. We see miles of inexperienced fields for extra unicorns in years to return.

What does this all imply?

The march of know-how has created so many extra unicorns, serving a a lot wider array of sectors. Crunching the numbers, you possibly can’t assist however mirror on the big societal and monetary impression VC-backed tech has had and get excited for extra historical past to unfold.

It looks like we’re residing throughout a brand new Industrial Revolution, powered by software program, that’s beginning to unfold to an increasing number of sectors of society. Less than 10% of in the present day’s Fortune 500 firms are tech firms. Within the subsequent 10 years, we count on the share to rise — and lots of to be from the 2023 herd.

We’ve additionally discovered indelible classes. That macroeconomic components and cycles matter. The huge inflow of personal capital brought on a proliferation of firms however a decline in capital effectivity self-discipline, which is able to degrade monetary outcomes for years, given what number of are nonetheless papercorns.

The cycle is way from over. The enterprise ecosystem will really feel the impression of the previous decade in years to return by way of extra shutdowns, down rounds and scarred founders, staff and traders.

Valuation can also be clearly a handy however imperfect, impermanent measure of success. Changing into a unicorn at a younger age may even be a curse! Founders in the present day can see how chasing self-importance valuations with weak underlying fundamentals can result in unintended poor outcomes.

There have been instances within the decade when many believed constructing a unicorn was straightforward and customary. Elder unicorns know that it’s not. It requires the sustained magic of product and velocity, buyer love, enterprise mannequin economics, capital effectivity, relentless execution and extra, over a few years.

We tip our hats as soon as once more to the lots of of firms (not tens!) that achieved and maintained unicorn milestones. Constructing and sustaining greater than $1 billion in worth up to now 10 years was statistically unbelievable and a serious, particular crew effort.

Lastly, should you made it this far, thanks for taking the time to dive into our labor of affection. We hope you loved it. We’d love feedback on what you appreciated most, disagree with, what we missed, or what you’d like extra of.

For extra like this (though we promise different posts are shorter), give us a comply with on LinkedIn, Medium, and X (@CowboyVC, @aileenlee, @allegra_v2).

Trending Merchandise